|

Global Economics

will be taking the next week off. Next article will be dated September 5.

The Week Ahead: Highlights

Asia-Pacific Preview

Busy Data Week plus Bank of Korea Policy Meeting

By Brian Jackson, Econoday Economist

The Bank of Korea's policy meeting will be a key focus in

the Asia-Pacific, with officials having cut rates in four of the last seven

meetings. At the previous meeting early last month, rates were left on hold,

with officials citing concerns about house price growth in the Seoul area

and higher household debt. Although they reiterated then that they have a

"rate cut stance", Governor Rhee Chang-yong this week told legislators

that there is "much to consider" at next week's meeting. This

suggests officials may decide to wait for further data before

cutting rates again.

South Korea will also publish retail sales and industrial

production data for July later in the week, with Taiwan and Singapore also

reporting industrial production data. These reports will provide updated

information on the impact higher tariffs on exports to the United States are

having on the region. This will be followed by official PMI data from China

providing one of the first indications of conditions in August.

Monthly CPI data for Australia for June may reinforce

the Reserve Bank of Australia's confidence that underlying inflation will

continue to moderate to around the midpoint of the target range of two percent

to three percent. Officials cut policy rates earlier this month based on this

assessment but they also stressed that they remain cautious about the outlook.

Europe Preview

Europe's Big Week: August Data to Show Tariff Effects

By Marco Babic, Econoday Economist

Data for August, the month in which US tariffs of 15 percent

have come into effect, has started to come in. Last week saw positive

developments in the flash PMI data for the month but the second quarter report

card for Germany reported worse-than-expected GDP for the second quarter.

Europe's largest economy shrank 0.3 percent, where exports were a drag.

France's economy fared better according to preliminary estimates, gaining 0.3

percent on the quarter, with final figures to be released on Friday. The flash

report is thin on details, and the final report will give a look into how the

trade component fared. Italy also reports final figures for the second quarter,

with the flash reading showing a 0.1 percent decline on the quarter and a 0.4

percent gain over the same three months of last year.

Another biggie next week is Germany's Ifo report for August. In July, the

results fell below consensus estimates but were still slightly improved over

the previous month. The question is whether German businesses, particularly

industry, remains positive in the face of US tariffs. In particular, autos are

facing tariffs and will likely to continue to do so unless Europe lowers

theirs.

German consumer confidence, scheduled for Wednesday, will be among the first

data points for September. In August, the reading slipped to minus 21.5 from

minus 20.3 in July, marked by consumers increasing their propensity to save.

Retail sales for July are scheduled for release and showed resilience in June,

gaining 1.0 percent on the month and 4.9 percent from a year ago. This,

however, could be consumers accelerating purchases ahead of potential tariff

hits. In Germany it appears at the moment that one sector is waiting for

improvement in another before committing to a more positive view.

Among other economies, Switzerland also reports final GDP for the second

quarter, with the flash reading 0.1 percent a marked slowdown from the 0.5

percent growth in the first quarter. The heavily trade-dependent Swiss economy

has seen exports decline for three consecutive months, and this is surely

bleeding into the GDP reading. Wednesday's report will provide more clarity on

that.

What Will the Inflation Data Show?

France reports preliminary July CPI and PPI readings on Friday, with Italy and

Germany reporting on consumer prices. In France, CPI has been relatively tame,

up 0.2 percent on the month, and 1.0 percent year-on-year in June. At the same

time, producer prices were down 0.2 percent on the month and up 0.2 percent on

the year. However, there has been anecdotal evidence in reports indicating

pipeline pressures could be brewing. Friday's data will give some direction on

that.

Italy's CPI is also within the comfort range of the ECB, rising 0.4 percent on

a monthly basis and 1.7 percent year-on-year in July. German inflation grew 0.3

percent in July and was up 2.0 percent over a year ago.

For now, this is unlikely to be of great concern to the ECB which is releasing

the minutes of its most recent meeting. The report will hopefully offer some

insights into the central bank's thinking on whether pipeline inflationary

pressure is something they are concerned about, but also any clues on how the

trade situation is playing out.

US Preview

GDP In Focus as FOMC Assesses Economy

By Theresa Sheehan, Econoday Economist

The economic data in the August 25 week advances the story

about economic conditions in the US in the third quarter 2025 with fresh data

for July and August. However, the highlight of the week - if it can be called

that - should be the second estimate of second quarter GDP.

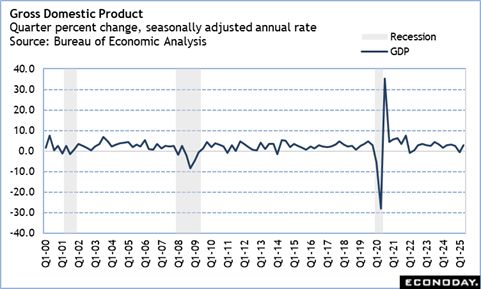

The advance estimate for the second quarter had a nice gain

of 3.0 percent compared to the decline of 0.5 percent in the first quarter. On

the other hand, the advance estimate is based on a number of assumptions. With

more data, the data is likely going to be revised. Some forecasters are looking

for growth to nudge up to 3.1 percent when the report is released at 8:30 ET on

Thursday. The Atlanta Fed's GDPNow forecasts growth at 2.3 percent as of August

19. Whatever the outcome, it has to be read with some caution. The BEA will be

releasing the annual revisions with the third estimate of second quarter GDP on

Thursday, September 25 at 8:30 ET.

In any case, Fed policymakers are going to be looking at the

performance of the first half of the year, in part to look behind the chaos of

the implementation of trade and tariff policies, and the impact of massive

layoffs in federal government. By the time the FOMC meets on September 16-17,

it will have a lot of information about the third quarter as well.

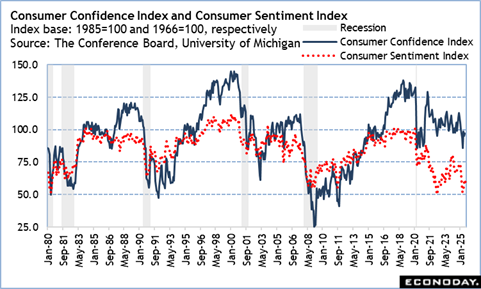

The week sees the last of the monthly surveys of consumer

confidence for August. The preliminary University of Michigan Consumer

Sentiment Index registered a decrease in early August to 58.6 from a rise to

61.7 in July. The fall was much more due to lower confidence in current

conditions, although the six-month outlook was softer as well. The cause is

likely worries about higher prices, especially for household nondiscretionary

spending like food and insurance. The final Consumer Sentiment Index for August

at 10:00 ET on Friday will probably see some revision but won't change the

underlying story. The Conference Board's Consumer Confidence Index for August

is at 10:00 ET on Tuesday. It remains to be seen if it mirrors the University

of Michigan measure with a decline in August after a small rise to 97.2 in

July.

Weak consumer confidence has not yet affected consumer

spending, but it does mean that consumers are seeking out bargains to maximize

their dollars and doing so when mulling gift budgets for the holiday shopping

season. Early bird shoppers can start as soon as September and October.

Retailers and wholesalers and delivery services plan their hiring now. Without

upward momentum for the confidence indexes, seasonal spending and hiring may

not see the usual gains in 2025 with consequent sapping of growth in the fourth

quarter.

The Week Ahead: Econoday Consensus Forecasts

Monday

New Zealand Retail Trade for Second Quarter (Mon 1045

NZST; Sun 2245 GMT; Sun 1845 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: -0.7% to 0.2%

The consensus sees retail trade up 0.2 percent in the

quarter from the previous quarter. After strength in Q1, sales flagged in Q2,

partly reflecting volatile auto sales.

Singapore CPI for July (Mon 1300 SGT; Mon 0500 GMT;

Mon 0100 EDT)

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.7% to 0.9%

CPI is expected to rise 0.8 percent from a year ago in July,

same as the 0.8 percent increase on year in June.

Germany Ifo Survey for August (Mon 1000 CEST; Mon 0800

GMT; Mon 0400 EDT)

Consensus Forecast, Business Climate: 88.3

Consensus Range, Business Climate: 87.0 to

88.6

Consensus Forecast, Current Conditions: 86.0

Consensus Range, Current Conditions: 85.0 to 86.6

Consensus Forecast, Business Expectations: 89.5

Consensus Range, Business Expectations: 89.0 to 90.4

Business climate is seen flat to weaker at 88.3 versus 88.6

in the prior month. Current conditions seen at 86.0 versus 86.5 and

expectations at 89.5 versus 90.7.

United States New Home Sales for July (Mon 1000 EDT; Mon

1400 GMT)

Consensus Forecast, Annual Rate: 628K

Consensus Range, Annual Rate: 615K to 650K

The consensus looks for home sales to languish at a shaky 628K

annual rate in July after 627K in June.

Tuesday

Singapore Industrial Production for July (Tue 1300

SGT; Tue 0500 GMT; Tue 0100 EDT)

Consensus Forecast, M/M: 0.9%

Consensus Range, M/M: 0.5% to 1.1%

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.5% to 1.7%

The consensus looks for output up 0.9 percent on the month

and up 0.8 percent on the year.

United States Durable Goods Orders for July (Tue 0830

EDT; Tue 1230 GMT)

Consensus Forecast, New Orders - M/M: -4.0%

Consensus Range, New Orders - M/M: -6.4% to 2.0%

Consensus Forecast, Ex-Transportation - M/M: 0.1%

Consensus Range, Ex-Transportation - M/M: -0.7% to 0.5%

Consensus Forecast, Core Capital Goods - M/M: 0.3%

Consensus Range, Core Capital Goods - M/M: -0.5% to 0.5%

Durable goods orders expected to show a decrease of 4.0

percent on the month with aircraft orders the swing factor for another month. The

consensus sees an increase of 0.1 percent ex-transportation orders. Core

capital goods orders, the capex proxy, is seen up by a decent 0.3 percent.

United States Case-Shiller Home Price Index for June (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, 20-City Unadjusted - Y/Y: 2.6%

Consensus Range, 20-City Unadjusted - Y/Y: 2.4% to 2.9%

Home prices are seen up 2.6 percent on year in June as housing

price inflation continues to ebb, down from 2.8 percent in May.

United States Consumer Confidence for August (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 96.4

Consensus Range, Index: 94.0 to 98.1

The consensus looks for a downtick to 96.4 in August from 97.2

in July. The Conference Board's measure has stabilized after taking a tumble

earlier in the year but confidence remains relatively depressed as consumers

fret about the job market.

Wednesday

Australia Monthly CPI for July (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, CPI - Y/Y: 2.3%

Consensus Range, CPI - Y/Y: 2.0% to 2.7%

CPI is expected to show a much bigger 2.3 percent rise on

year in July versus 1.9 percent in June. June was skewed down by a big 0.4

percent drop in electricity prices and that factor is seen reversing in July.

Germany GfK Consumer Climate for September (Mon 0800 CEST;

Mon 0600 GMT; Mon 0200 EDT)

Consensus Forecast, Index: -21.5

Consensus Range, Index: -23.0 to -20.5

German consumers remain gloomy with change in the index

expected flat at minus 21.5 in September from August's minus 21.5.

Thursday

South Korea Bank of Korea Announcement (Thu 1000 KST;

Thu 0100 GMT; Wed 2100 EDT)

Consensus Forecast, Change: 0 bps

Consensus Range, Change: 0 bps to 0 bps

Consensus Forecast, Level: 2.50%

Consensus Range, Level: 2.50% to 2.50%

Forecasters expect the bank to hold off on a rate cut until

the October meeting but markets are watching closely the BOK's economic

projections. For now the upside concern is housing price inflation and rising

consumption in response to government payouts.

Australia Capital Expenditures for Second Quarter (Thu

1130 AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: -0.5% to 2.0%

Spending on Capex seen up 0.8 percent in Q2 from Q1 after

falling 0.1 percent in Q1 from Q4.

Switzerland GDP for Second Quarter (Thu 1000 CEST;

Thu 0800 GMT; Thu 0400 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.1% to 0.1%

A muted 0.1 percent increase expected on quarter, unchanged

from the flash.

Eurozone M3 Money Supply for July (Thu 1000 CEST; Thu

0800 GMT; Thu 0400 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 3.4%

Consensus Range, Y/Y - 3-Month Moving Average: 3.1%

to 3.7%

Money supply growth expected at 3.4 percent in July versus

3.7 percent in June.

Eurozone EC Consumer Sentiment for August (Thu 1100

CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, Economic Sentiment: 96.0

Consensus Range, Economic Sentiment: 95.2 to 96.5

Consensus Forecast, Industry Sentiment: -11.0

Consensus Range, Industry Sentiment: -11.0 to -9.0

Economic sentiment expected at 96.0 for August versus 95.8

in July.

United States GDP for Second Quarter (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

3.1%

Consensus Range, Quarter over Quarter - Annual Rate: 3.0%

to 3.2%

Consensus Forecast, Personal Consumption Expenditures -

Annual Rate: 1.4%

Consensus Range, Personal Consumption Expenditures -

Annual Rate: 1.4% to 1.5%

The consensus sees GDP revised up marginally to show a 3.1

percent growth rate in Q2 from the 3.0 percent initial report. Personal

consumption expected unrevised at 1.4 percent.

United States Jobless Claims for Week 8/23 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 230K

Consensus Range, Initial Claims - Level: 228K to 236K

After an unexpected 11K jump to 235K last week, claims

expected to retreat a bit toward the 4-week moving average (226.25K) to reach 230K.

United States Pending Home Sales Index for July (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.2% to 0.5%

Sales expected to retrace by 0.2 percent after dropping 0.8

percent in June. Home sales not looking good.

Friday

South Korea Industrial Production for July (Fri 0800

KST; Thu 2300 GMT; Thu 1900 EDT)

Consensus Forecast, M/M: 1.2%

Consensus Range, M/M: 0.5% to 2.1%

Output expected up another 1.2 percent on the month in July

after rising 1.6 percent in June.

Japan Tokyo CPI for August (Fri 0830 JST; Thu 2330 GMT;

Thu 1930 EDT)

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.3% to 2.8%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.6%

Consensus Range, Ex-Fresh Food - Y/Y: 2.2% to 2.8%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.1%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.8%

to 3.1%

Key forecast points:

--Consumer inflation in Tokyo, the leading indicator of the

national average, is expected to have slowed further to 2.6% in August in the

core measure (excluding fresh food) after having decelerated to 2.9% in July

from 3.1% in June. The main drivers remain the same as in the previous month:

nationwide retail gasoline and heating oil subsidies and a plunge in water

bills thanks to the city's free base charge for four months that began in June.

--The year-on-year rise in the total CPI is also seen

decelerating to 2.6% after slowing to 2.9% in July from 3.1% in June, showing

similar patterns as in the core reading. The annual rate for the core-core CPI

(excluding fresh food and energy), which is little affected by fluctuations in

gasoline and heating oil prices, is expected remain notably sticker at 3.1%

after staying at 3.1% in July and easing to the level in June from 3.3% in May.

--Lower inbound spending amid the stronger yen vs. its

weakness seen last year is also helping ease upward pressures on consumer

prices. Energy prices are expected to post a year-on-year decline for the

second straight month following many months of gains. On the upside, elevated

processed food prices continue to hurt households. Serious domestic rice supply

shortages have eased but regular rice prices in Tokyo's 23-ward areas were

still up 81.2% on the year in July, only slightly slower than 89.2% in June and

93.2% in May. The deceleration pace in August is also expected to be gradual.

Japan Unemployment Rate for July (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.4% to 2.5%

Key forecast:

--The seasonally adjusted unemployment rate in Japan is

forecast to stay low and stable at 2.5% in July after staying at the rate in

the previous four months and edging down to 2.4% in February. Payrolls seen up

on year for the 36th straight month amid widespread labor shortages. Other data

show real wages are falling amid high costs of living.

--The government continues to describe employment conditions

as "showing signs of improvement" in its latest monthly economic report

but real wages fell for the sixth straight month in June, down 1.3% on the

year, in the face of rising costs of living while nominal wages gained a modest

2.5%.

Japan Industrial Production for July (Fri 0850 JST; Thu

2350 GMT; Thu 1950 EDT)

Consensus Forecast, M/M: -1.5%

Consensus Range, M/M: -2.3% to -0.3%

Consensus Forecast, Y/Y: -0.7%

Consensus Range, Y/Y: -5.3% to 0.4%

Key forecast points:

--Japan's industrial production is forecast to slip back

1.5% on the month in July after marking its first rise in three months in June

with a solid 2.1% gain (revised up from +1.7%) as the uncertainty over both

global and domestic demand lingers even in the wake of trade deals between

Tokyo and Washington, news of which appeared to come in a little too late for

firms to digest.

--Factory output is seen down 0.7% on year after marking a

solid 4.0% rise in June and falling 2.4% in May, which was the first drop in

five months.

--The monthly survey by the Ministry of Economy, Trade and

Industry released last month indicated that output would output would slip 1.0%

in July before rising 0.8% in August, led by production machinery as well as

iron/steel and non-ferrous metals.

--METI is likely to maintain its assessment (the last change

was an upgrade in July 2024), saying industrial output is "taking one step

forward and one step back."

Japan Retail Sales for July (Fri 0850 JST; Thu 2350 GMT;

Thu 1950 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.6% to 0.5%

Consensus Forecast, Y/Y: 1.8%

Consensus Range, Y/Y: 1.0% to 2.6%

Key forecasts:

--Japanese retail sales are forecast to show a modest 1.8%

rise on the year in July, staying on a sluggish trend following a 1.9% gain in

each of the previous two months and slowing from +3.5% in April, as consumers

had already scrambled to replace or repair their existing air conditioners

before June in anticipation of life-threatening heat waves and typhoons.

--Retail sales are seen nearly flat on a seasonally adjusted

basis, up just 0.1% after rising a solid 1.0% in June, slipping 0.6% in May and

rising 0.7% in April.

--Government subsidies have cut fuel prices in recent

months, exerting downward pressures on retail sales while demand for drugs and

cosmetics stays intact.

--Department store sales posted a sixth straight

year-on-year decline, hit by lower inbound spending amid a firmer yen and

stricter duty-free shopping rules.

--New passenger car sales units posted their first y/y drop

in seven months in July but vehicle sales in METI's retail sales are provide

only in values and thus could paint a complexly different picture than what

industry data had shown. Demand for vehicles has been on a gradual recovery

trend after last year's production suspension by the Toyota Motor group over

safety test scandals.

Germany Retail Sales for July (Fri 0800 CEST; Fri 0600

GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.5% to 0.3%

Sales expected flat on the month in July after surging by

1.0 percent on the month in June.

France GDP for Second Quarter (Fri 0845 CEST; Fri

0645 GMT; Fri 0245 EDT)

Consensus Forecast, Q/Q: 0.3%

Consensus Range, Q/Q: 0.3% to 0.3%

Consensus Forecast, Y/Y: 0.7%

Consensus Range, Y/Y: 0.7% to 0.7%

No revision expected from the flash with a strong 0.3

percent rise on quarter.

Germany Unemployment Rate for August (Fri 0955 CEST; Fri

0755 GMT; Fri 0355 EDT)

Consensus Forecast, Rate: 6.4%

Consensus Range, Rate: 6.3% to 6.4%

The consensus looks for unemployment to tick higher to 6.4

percent in August from 6.3 percent in July.

Italy GDP for Second Quarter (Fri 1000 CEST; Fri 0800

GMT; Fri 0400 EDT)

Consensus Forecast, Q/Q: -0.1%

Consensus Range, Q/Q: -0.1% to -0.1

Consensus Forecast, Y/Y: 0.4%

Consensus Range, Y/Y: 0.4% to 0.4%

No revision expected from the flash with a 0.1 percent decline

on quarter.

Germany CPI for August (Fri 1400 CEST; Thu 1200 GMT; Thu

0800 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.1%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 1.9% to 2.2%

Consensus Forecast, HICP - M/M: 0.1%

Consensus Range, HICP - M/M: 0.1% to O.1%

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 1.9% to 2.1%

The consensus sees German CPI up 0.1 percent on the quarter

and up 2.1 percent on year.

India GDP for Second Quarter (Fri 1730 IST; Fri 1200

GMT; Fri 0800 EDT)

Consensus Forecast, Y/Y: 6.6%

Consensus Range, Y/Y: 6.4% to 7.0%

GDP seen up 6.6 percent on year in Q2 versus 7.4 percent in

Q1.

Canada Monthly GDP for June (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.2%

Another marginal 0.1 percent rise expected for Canada's GDP

in June from May. At least it's positive.

Canada GDP for Second Quarter (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, Annual Rate: -0.4%

Consensus Range, Annual Rate: -1.0% to 0.2%

Tariff angst whacked Canada's economy in Q2 with net exports

and Capex suffering while consumer spending fared relatively well. The

consensus sees a decline of 0.4 percent at an annual rate. The Bank of Canada

was looking for minus 1.5 percent.

United States International Trade in Goods (Advance) for

July (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Balance: -$87.7 B

Consensus Range, Balance: -$99.8 -$87.0 B

The consensus forecast looks for the merchandise trade gap

at $87.7 billion in June versus $86.0 billion in June.

United States Personal Income and Outlays for July (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.4%

Consensus Range, Personal Income - M/M: 0.3% to 0.5%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.5%

Consensus Range, Personal Consumption Expenditures - M/M:

0.3% to 0.6%

Consensus Forecast, PCE Price Index - M/M: 0.2%

Consensus Range, PCE Price Index - M/M: 0.2% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.6%

Consensus Range, PCE Price Index - Y/Y: 2.6% to 2.7%

Consensus Forecast, Core PCE Price Index - M/M: 0.3%

Consensus Range, Core PCE Price Index - M/M: 0.2% to 0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.9%

Consensus Range, Core PCE Price Index - Y/Y: 2.8%% to

3.0%

Income expected up 0.4 percent and spending up 0.5 percent

on the month. Core PCE prices seen up 0.3 percent versus 0.3 percent in June.

United States Chicago PMI for August (Fri 0945 EDT; Fri

1345 GMT)

Consensus Forecast, Index: 45.2

Consensus Range, Index: 45.0 to 48.3

Chicago PMI seen ebbing to 45.2 in Augus versus 47.1 in

July.

United States Consumer Sentiment for August (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 58.6

Consensus Range, Index: 58.0 to 60.5

The final University of Michigan index is expected unrevised

at 58.6.

|